Иницирање на плаќање

Преглед

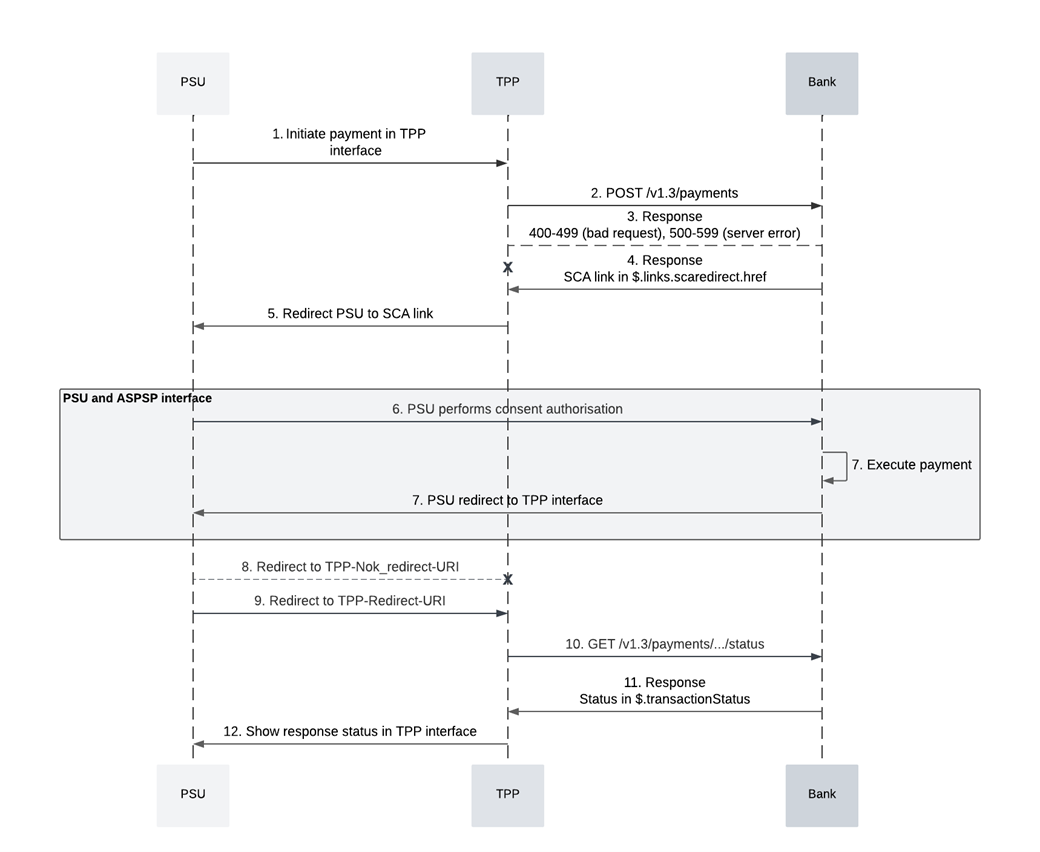

Услугата за иницирање на плаќање (PIS) им овозможува на TPP субјектите да иницираат плаќања. За да иницира плаќање, TPP има потреба од авторизација (одобрување на трансакцијата) од Корисникот на платните услуги (PSU). PSU го дава своето одобрение за време на SCA сесијата.

Опис на текот

Подолу е даден опис на интеграциониот тек во кој TPP иницира редовен домашен KIBS кредитен трансфер. Овој тек претпоставува дека:

- TPP избира експлицитен почеток на авторизацијата со поставување на хедерот

Client-Explicit-Authorisation-Preferred: True; - Банката бара Redirect SCA за иницираната трансакција.

Забелешка: Прикажаниот тек подолу се фокусира на комуникацијата помеѓу TPP и XS2A интерфејсот на платформата за отворено банкарство (OBP), поедноставувајќи ги деталите за комуникацијата помеѓу OBP и банката.

Чекор 1

Корисникот на платните услуги (PSU) го започнува процесот на плаќање преку интерфејсот на TPP.

Чекор 2

TPP повикува

POST /payments/domestic-credit-transfers-kibs за да го иницира плаќањето:curl -X POST "https://api.ob.kibs.mk/pis/v2/payments/domestic-credit-transfers-kibs" -H "X-Request-Id: dc7b16a5-4ac8-4fdc-9c4e-9f9d0387dc07" -H "Content-Type: application/json" -H "PSU-ID: 446456475755" -H "PSU-IP-Address: 123.321.123.321" -H "Client-Explicit-Authorisation-Preferred: True" -H 'Authorization: Bearer eyJhbGciOiJSUzI1NiIsInR5cCIgOiAiSldUIiwia2lkIiA.......' -d '{ "categoryPurposeProprietary": "3", "purposeProprietary": "999", "debtorAccount": { "iban": "MK07200002785493215", "currency": "MKD" }, "creditorAccount": { "iban": "MK07200003215498765", "currency": "MKD" }, "creditor": { "name": "ABC Company" }, "debtor": { "name": "John Doe" }, "instructedAmount": { "currency": "MKD", "amount": "25000.00" }, "chargeBearer": "SHAR", "creditorAgent": { "bic": "KOBSMK2X" }, "debtorAgent": { "bic": "EXAMPLEMKXXX" }, "requestedExecutionDate": "2025-12-28" }'

Чекор 3

OBP враќа уникатен идентификатор на трансакцијата за плаќањето:

{ "paymentId": "e521cf62-a45f-49c5-8372-94853fffeb55", "transactionStatus": "RCVD", "_links": { "startAuthorisation": { "href": "payments/domestic-credit-transfers-kibs/e521cf62-a45f-49c5-8372-94853fffeb55/authorisations" } } }

Чекор 4

TPP повикува

POST /payments/{payment-product}/{payment-id}/authorisations (со Client-Redirect-URI и Client-Redirect-Nok-URI хедери) за експлицитно започнување на авторизацијата (SCA).Чекор 5

OBP ја враќа SCA Redirect URL (

$.links.scaRedirect.href) за PSU да изврши силна клиентска автентикација (SCA):{ "scaStatus": "received", "authorisationId": "d3f9c3f2-7a8f-4c7f-9b7e-b02e6fdc9420", "_links": { "self": { "href": "/pis/v2/payments/domestic-credit-transfers-kibs/e521cf62-a45f-49c5-8372-94853fffeb55/authorisations/d3f9c3f2-7a8f-4c7f-9b7e-b02e6fdc9420" }, "scaRedirect": { "href": "https://bankscaserver.com/auth/d3f9c3f2-7a8f-4c7f-9b7e-b02e6fdc9420" } } }

Чекор 6

TPP го пренасочува PSU кон SCA Redirect URL на банката. Ова е веб-страница на банката каде PSU треба да се автентицира и да ја одобри трансакцијата.

Чекор 7

PSU ја завршува авторизацијата во интерфејсот на банката (веб или мобилен).

Чекори 8

Банката го процесира плаќањето внатрешно.

Чекори 9–10

Банката го пренасочува PSU назад кон TPP користејќи го

Client-Redirect-URI кој го обезбедил TPP.Чекор 11

TPP повикува

GET /payments/{payment-product}/{payment-id}/status за да го провери тековниот статус на плаќањето.Чекор 12

OBP го бара најновиот статус на плаќањето од банката.

Чекор 13

Банката му го доставува статусот на плаќањето на OBP.

Чекор 14

OBP го испраќа статусот на плаќањето назад до TPP:

{ "transactionStatus": "ACCC" }

Чекор 15

PSU е информиран за конечниот резултат од плаќањето преку интерфејсот на TPP.

PIS-специфични кодови за грешки

| Сценарио | Грешка |

|---|---|

| Адресираниот платежен производ не е поддржан од ASPSP. | 404 – PRODUCT_UNKNOWN |

| Барањето за иницирање на плаќање (POST) не успеа во почетниот процес. Дополнителни информации може да бидат обезбедени од ASPSP. | 400 – PAYMENT_FAILED |

| Оваа услуга не е достапна за адресираниот PSU поради блокада независна од канал, поставена од ASPSP. | 403 – SERVICE_BLOCKED |